4 E-Z Pieces to Solving Your Financial Puzzle

Just like other accounting software programs, Big E-Z helps you put together your financial puzzle; we just use bigger and fewer pieces. Here are 4 E-Z pieces to solving your financial puzzle. We’ll outline them here and you can use Big E-Z Accounting to put them all together.

Step 1: Enter or Import Transactions

You’ve probably heard this advice on how to make good decisions: “Consider everything.” You’ll want to enter all your transactions into one system; this includes your checking, savings, all your credit cards, merchant transactions, etc. So if you have just a few transactions, you can enter them row by row.

If you have lots of transactions, you will save time by using our powerful importer. Using the importer reflects exactly what the bank has on record for your account, creating less room for errors. Our unique importer even allows you to trim unnecessary bank-generated words before they are imported. All this will give you a true accounting of your financial activity.

In the Big E-Z Accounting system, import all your transactions by following these instructions.

Step 2: Track/Categorize Expenses

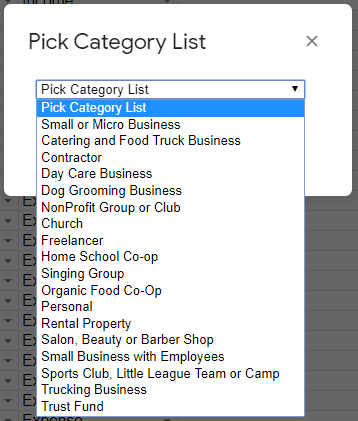

As the saying goes, “a place for everything, and everything in its place.” In this system you can easily place each transaction into its proper Category. Each of our 36 preset lists includes suggested tax-deductible expense categories for small businesses and nonprofits. Choose a list that best fits your organization.

You can customize the Categories to fit your needs or import a complete list of income and expense Categories from your previous accounting program.

Step 3: Catch Accounting Errors

You know the saying, “Garbage In, Garbage Out.” Now that everything is entered, it is important to check the accuracy of your data.

Here’s how Big E-Z helps you check for accuracy:

We have an exclusive section within our program to help you find errors. It’s called Lookup / Find Errors. You can find entries you forgot to categorize or determine if your transfers between ACCOUNTS were handled correctly.

We also have a unique Control Sheet that allows you to see if your Balance Sheet and Direct Cash Flow reports actually balance. You can keep tabs on your profits and stay up to date on your actual available cash balance as well.

Reconcile your ACCOUNTS on a regular basis to match up your records to your financial institution’s and note any differences. This proves your records are accurate.

Step 4: Share Reports in Real Time

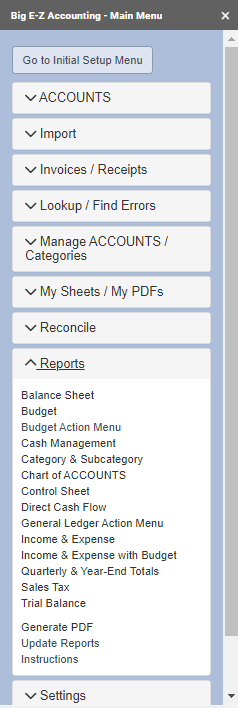

Now you will able to share accurate and professional-looking reports with your team. If you share the Google sheet and allow edit access, your team can collaborate in real time with your organization. This is a huge benefit to many that use this program. For more information on reports, watch our 3-minute tour of the reports section.

See a list of reports in the image below:

Big E-Z Accounting also allows you to add your own reports. You can do this by adding a sheet and it will show up under My Sheets /My PDFs. This can be a convenient place to easily locate other reports.

Following these 4 steps will resolve your financial puzzle. Great benefits are the ability to plan for future purchases, have peace of mind that everything is in order, know you are in control of your finances, and stay organized for tax time.

Happy bookkeeping!