by Michelle Carley, Big E-Z Bookkeeping Co., Founder | Aug 28, 2025 | Accounting Best Practices

If you’re running a business—even as a solo entrepreneur—you’ve likely heard this advice: “Keep your business and personal finances separate.” But do you know why it matters so much? Let’s talk about something important that could protect (or put at risk) your...

by Michelle Carley, Big E-Z Bookkeeping Co., Founder | Jun 5, 2025 | Accounting Best Practices

It’s already June—can you believe it? This time of year, many small business owners look up and realize things have gotten a little… messy. Life gets busy, receipts pile up, and bookkeeping falls behind. Don’t worry—you’re not alone. Now is the perfect moment for a...

by Michelle Carley, Big E-Z Bookkeeping Co., Founder | May 6, 2025 | Accounting Best Practices

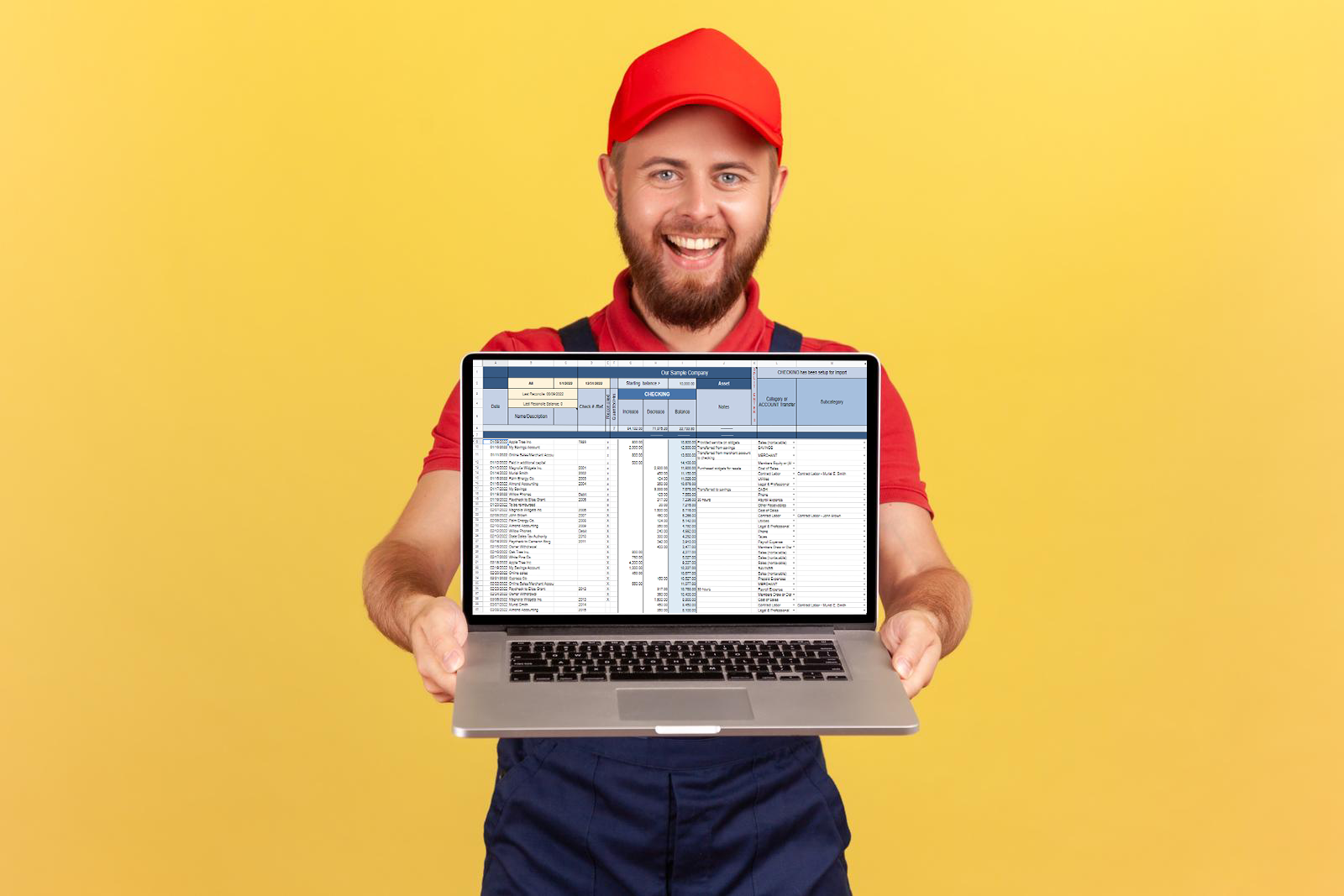

Running a business is hard enough—bookkeeping doesn’t have to be! This month, we’re shining a light on one of the most underrated tools in your business toolkit: consistency. Keeping your books up to date each month not only saves you time during tax season, but it...

by Michelle Carley, Big E-Z Bookkeeping Co., Founder | Apr 8, 2025 | Accounting Best Practices

Tax time doesn’t have to be a last-minute scramble! With a little preparation, you can approach next year’s tax season with confidence and peace of mind. Here’s how: ✅ Organize Your Records – Keep receipts, income statements, and deductible expenses in one place. A...

by Michelle Carley, Big E-Z Bookkeeping Co., Founder | Feb 27, 2025 | Accounting Best Practices

Spring is Here—Time to Tidy Up Your Financial Records! As we welcome the new season, it’s the perfect time to refresh your approach to recordkeeping. A well-structured records retention policy ensures you keep essential financial documents while eliminating...